Steuerfreie Einkünfte (tax-free income) grew directly out of the long-time project Bilder von der Straße. Looking out for abandonded photographs in the streets, it was inevitable that I found other things, too, such as money. Usually, this would be in the form of small coins but occasionally, I would find a banknote. For many years I simply picked all these up and put them in my wallet. In 2011, I began to make annual inventories of the found money after an interesting dispute with the fiscal authorities about tax-deductible expenses and the character of some of my works such as Bilder von der Straße.

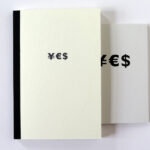

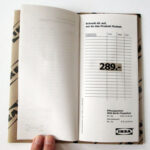

The project’s accounting is public. A complete report was published in book form after the ten-year project was completed.

Tax-free income accumulated in

2011: CAD 0.25 + DEM 0.01 + EUR 0.97 + GBP 0.06 + USD 0.20 – Total: EUR 1.37

2012: CAD 0.01 + CHF 1.00 + EUR 4.49 + PLN 0.04 + USD 1.67 – Total: EUR 6.34

2013: EUR 19.30 + GBP 0.28 + MAD 5.00 + PLN 2.02 + USD 0.42 $ – Total: EUR 20.87

2014: CHF 0.05 + DKK 1.00 + EUR 23.63 + GBP 0.01 + MXN 0.10 + USD 3.60 $ – Total: EUR 26.77

2015: BGN 0.01 + CAD 0.05 + CHF 0.05 + DDM 0.20 + DEM 0.01 + EUR 24.51 + TRY 0.10 + USD 5.59 – Total: EUR 29.91

2016: CHF 0.50 + DKK 2.50 + EUR 7.02 + GBP 1.05 + USD 0.58 – Total: EUR 9.53

2017: EUR 9.36 + USD 0.42 – Total: EUR 9.71

2018: CNY 1.20 + CZK 2.00 + EUR 8.72 + GBP 0.05 + THB 0.50 – Total: EUR 9.03

2019: BRL 0.60 + CZK 1.00 + EUR 13.39 + PLN 0.10 – Total: EUR 13.59

2020: EUR 14.39 – Total: EUR 14.39

Total 2011–2020: EUR 141.51

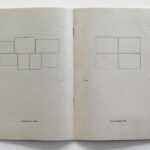

BGN 0,01

BRL 0,60

CAD 0,31

CHF 1,60

CNY 1,20

CZK 3,00

DDM 0,20

DEM 0,02

DKK 3,50

EUR 125,78

GBP 1,45

MAD 5,00

MXN 0,10

PLN 2,16

THB 0,50

TRY 0,10

USD 12,48